puerto rico tax incentive program

MESSAGE FROM THE SECRETARY OF. Under this incentive all eligible export goods and services business income.

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years.

. This is done through the formation of investment capital funds aimed at investing in companies that do not have access to public markets and establish the applicable. In 2017 the Economic Development Department conducted a study to evaluate the cost and performance of the economic incentives granted. Benefits of establishing relocating or expanding businesses in Puerto Rico.

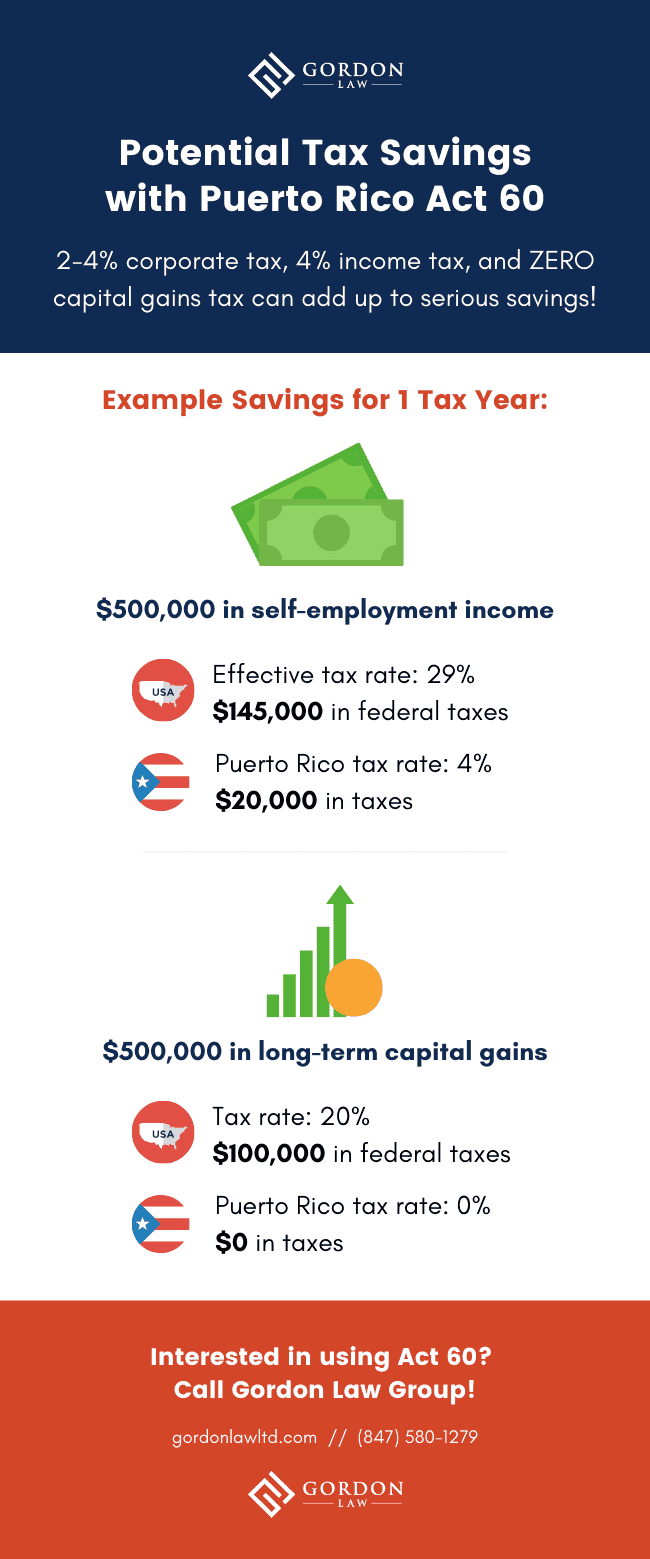

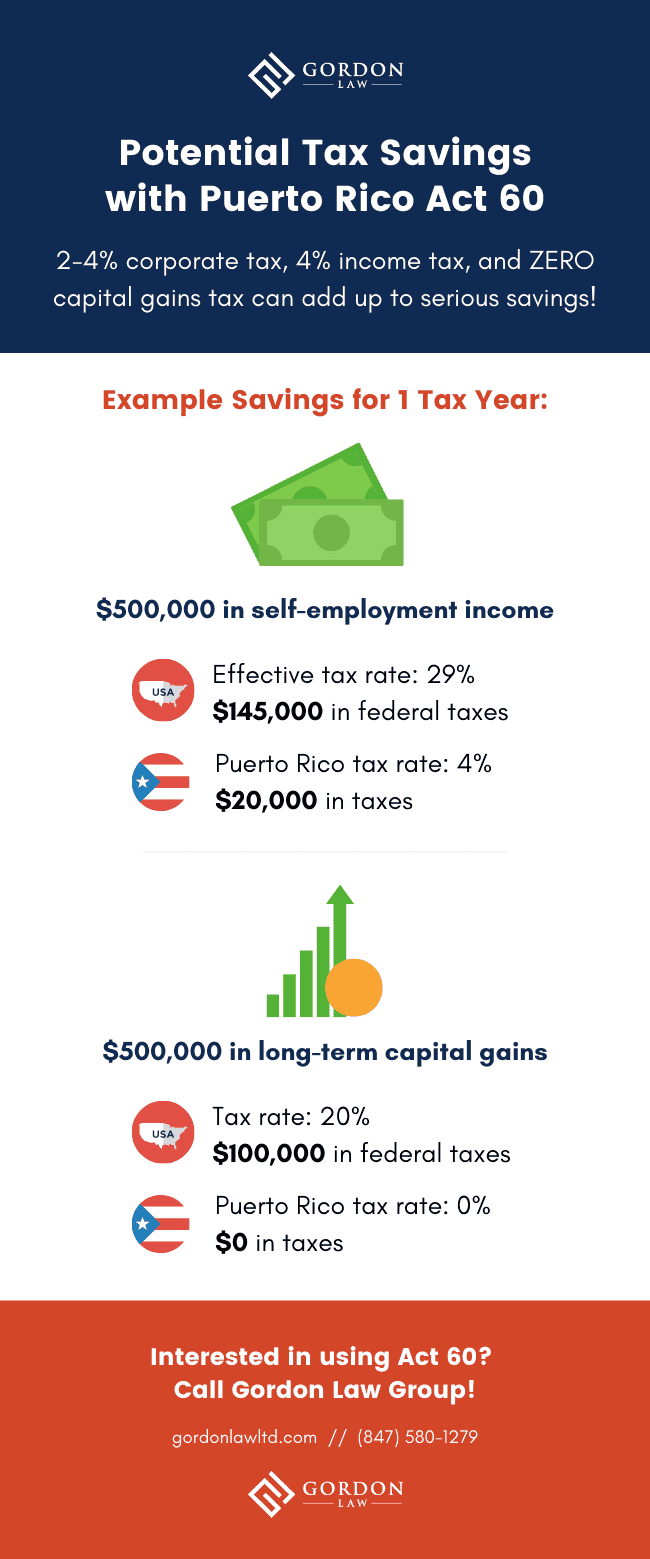

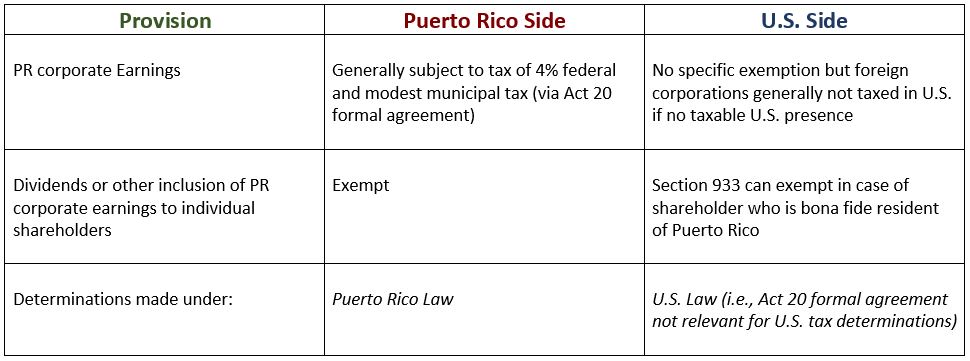

Assets by establishing bona fide residence in Puerto Rico unless recognized after 10 years of bona fide residence in Puerto Rico. A Puerto Rican corporation thats engaged in certain types of service businesses only pays Puerto Rican tax of 4. HUD Clarifies Position on Puerto Rico Tax Incentive Program.

In Puerto Rico are perhaps the most impressive of all Puerto Rican tax incentives. Part of Puerto Ricos government tax incentive programs require buying a home within the first two years of a move and you have to pay for. Feature films short films documentaries television programs series in episodes mini-series music videos national and international commercials video games and post-production projects.

100 tax exemption from Puerto Rico income taxes on all interest. Taxes generally apply to income and appreciation occurring after. INCOME TAX RETURN FOR EXEMPT BUSINESSES UNDER THE PUERTO RICO INCENTIVES PROGRAMS.

Known as the Puerto Rico Incentive Code to. Has a Puerto Rico corporate income tax rate of 4 businesses located in Vieques or Culebra and businesses with income under 3MM are eligible for only 2 tax Distributions are taxed at 0 to PR. COMMONWEALTH OF PUERTO RICO DEPARTMENT OF THE TREASURY Income Tax Return for Exempt Businesses Under the Puerto Rico Incentives Programs Part I TAXABLE YEAR BEGINNING ON _____ ____ AND ENDING ON _____ _____ Payment Stamp Contracts with Governmental Entities Yes No CHANGE OF ADDRESS Yes No 2000 RETURN Spanish English.

0 tax on owner profit distributions dividends. Puerto Rico requires to invest in competitive activities of high economic value and positive performance. Ii a total or partial.

Puerto Ricos Act 185 Tax Incentive Program The purpose of the Act 185 tax incentive is to establish the Private Equity Fund Act to promote the development of private capital in Puerto Rico. The tax incentive program which was first created as the 2012 Act 20 and Act 22 programs could not. The new law does NOT eliminate the existing incentives.

90 exemption from municipal and state taxes on property. Benefits of the incentives Strengthening the compliance with and the auditing of the incentives Improving Puerto Ricos economic competitiveness Act 60. 4 fixed corporate income tax rate.

Make Puerto Rico Your New Home. Tax credits for jobs created. The tax incentives enjoyed by Individual Resident Investors.

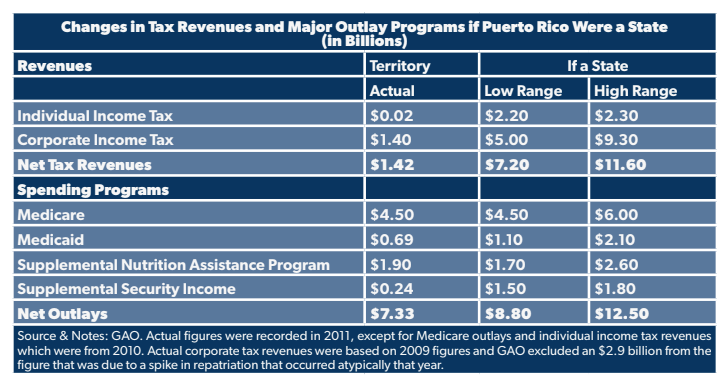

The legislation allows Puerto Rico to offer qualifying businesses that export services from the island nation the opportunity to cut their corporate tax rate to a mere 4. The findings were the following. To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentive Code.

Tax and incentives guide. 0 or 1 income tax on endeavors categorized as pioneer industries. - WAGE SUBSIDY PROGRAM FOR AGRICULTURAL WORKERS 294.

The two well-known Puerto Rican tax incentives are Export Services formerly Act 20 and Individual Resident Investor formerly Act 22 but they arent the only tax incentives Puerto Rico offers. Tax credits of 50 of qualified investment. Is exempt from US taxation under IRC 933 and IRC 937.

The Tax Cuts and Jobs Act introduced major changes to the international tax provisions of the United States Internal Revenue Code of 1986 as amended which generally govern the tax consequences to US persons with operations through foreign corporations. The revised opinion was. Now known as Chapter 3 of the Incentives Code Puerto Ricos Act 20 was originally known as the Export Services Act.

Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. Puerto Rico offers the security and stability of operating in a US jurisdiction with an array of special tax incentives for foreign direct investment that can be found nowhere else in the world. 100 tax exemption from Puerto Rico income taxes on all short-term and long-term.

Puerto Ricos Incentives Code 4 fixed income tax on eligible income 0 tax on Capital Gains Dividends Interest Crypto Gains1 Up to 50 back in tradeable tax credits on RD expenditures Up to 50 back in tradeable tax. Tax credits of up to 25 of products manufactured in Puerto Rico. In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code.

Heres the guidance being put out by most of the major firms in Puerto Rico on the tax incentive programs. 60-2019 as amended known as the Puerto Rico Incentive Code. 22-2016 provides up to 11 energy credit if the tourism activity is endorsed by the PRTC and complies with the requirement stated in this form.

The Puerto Rican tax incentives and the exemption from US. 2003 1 COMMONWEALTH OF PUERTO RICO DEPARTMENT OF THE TREASURY PO BOX 9022501 SAN JUAN PR 00902-2501. Thousands of Americans have already moved to the US-owned Caribbean island under the program to take advantage of Act 60s tax benefits with Puerto Ricos stunning beaches and vibrant culture serving as two added incentives in favor of the move.

INCOME TAX RETURN FOR EXEMPT BUSINESSES UNDER THE PUERTO RICO INCENTIVES PROGRAMS. 100 exemption from municipal license taxes and other municipal taxes. I a preferred tax rate.

100 tax exemption from Puerto Rico income taxes on all dividends. The Tax Incentives Office provides assistance to the Economic Development Bank of Puerto Rico in evaluating the loan applications for the development of tourism activities. This rule would seem to frustrate the purposes of Puerto Ricos incentive programs.

The existence of 58 incentive laws or programs to promote economic activities. The 2008 Economic Incentives for the Development of Puerto Rico Act EIA provides a wide array of tax credits and incentives that enable local and foreign companies dedicated to certain business activities to operate within Puerto Rico. Under the Puerto Rico Incentives Programs.

Commerce of Puerto Rico for a tax exemption or tax benefit decree under the subtitles or chapters of Act No. In light of a recent letter from the Appraisal Institute the Department of Housing and Urban Development has reversed its opinion and now views Puerto Ricos Law 197 as a sales incentive or inducement and expects FHA Roster appraisers to appraise such properties accordingly.

Guide To Income Tax In Puerto Rico

Overview Relocate And Move To Puerto Rico With Act 20 Act 22

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Offers The Lowest Effective Corporate Income Tax

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Cares Act A Lifeboat For Puerto Rico Insights Dla Piper Global Law Firm

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

Puerto Rico Income Tax Return Prepare Mail Tax Forms

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Guide To Income Tax In Puerto Rico

Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativocentro De Periodismo Investigativo

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22